Pricing and Features

Taxbrain offers four different plans: 1040 EZ, 1040 Basic, 1040 Deluxe, and 1040 Premium. 1040 EZ is created for single or married taxpayers under 65 without any children, whose the main source of income stem from wages, scholarships, unemployment or taxable interest. Aside from these, your taxable income should also be less than $100,000, you are only claiming for income tax credit, and you did not receive any advance earned income credit payments. This plan costs $14.95, with the option for state tax return service for an additional $19.95.

1040 Basic was designed for the tax filer with dependent children, allowing several tax credits such as the Child Tax Credit, Additional Child Tax Credit, Education Credits, and dependent care expenses. It is also the advisable package for individuals who have moved elsewhere in pursuit of a new job or taken an early withdrawal from an IRA. It costs $19.95 with the optional state tax returns for $29.95.

Next, with 1040 Deluxe, you will enjoy a package that can help maximize your credits and deductions. The user interface under this package is structured so that you will have an efficient process in finishing the forms, and not the tedious and usual one question, one answer portion. Some of the additional forms included in this service are: Schedule A, D, K1 1065, K-1 1120S, a number of forms, and a home sale worksheet. The price tag for this package is $39.95 with an additional $29.95 for state tax returns.

Last but not the least is the 1040 Premium package, which is the perfect product for small business filers, rental owners and the self-employed. With this service, you can take advantage of every opportunity in deductions and credits and be able to minimize your dues and focus your budget on the success of your business. Aside from the basic and deluxe features, in contains more forms to ensure that all your tracks are covered. It costs $69.95 and the additional state tax returns for $29.95.

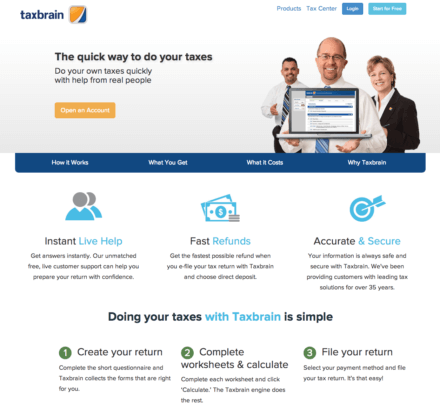

Aside from these great packages, Taxbrain also offers the use of their tax tools for free. You can make use of their Tax Estimator to quickly determine how much you will be having for your tax return, or how much you will have to pay. Their W-4 calculator, meanwhile, helps you determine if you are interested in a bigger tax refund or an increase in your take home pay. Always be punctual in filing your taxes and know the needed documentation with their Tax Extensions. Lastly, if you want more information on taxes and read up on advices and ideas, their blog is always open for all to see.

Customer Support

If you need assistance on your income tax preparation, Taxbrain offers an in depth Knowledgebase that contains pertinent tax law information to help you get up to speed. For any questions and clarifications on the functions of the software itself, they offer a live chat support, hotline, and email to reach their support team. Their office is available from Monday to Friday, 9AM to 5 PM EST. You can also connect with them via Facebook and Twitter for an instant and direct contact.

Accuracy Guarantee

Taxbrain gives you the assurance that the computation and amounts presented by their online tax program is correct and accurate. In case of any error, they will gladly pay for the interest and penalties incurred as assessed by the IRS due to the mistake. Which means you won’t have to worry about paying for something that is not your fault. Moreover, their customer support team is more than happy to lend a hand in sorting out your taxes- an assistance you would likely be needing should you encounter complications in your taxes. Whatever your status is, whether you are filing as an individual or for a whole business, Taxbrain has you covered.

What's the Verdict on Taxbrain?

Taxbrain Review 2020 – Conclusion

At its very core, Taxbrain is very helpful in simplifying the whole tax filing process with a reasonable price to boot. They do have certain drawbacks that may make you re-think about considering their services, like the need to pay more to maximize your credits and deductions and isolated cases of delayed refund. However, with the other features that they offer, like their accuracy guarantee, innovative tax tools and a free, no strings attached trial, you’d be missing out if you don’t give them a try. Go and check out the wonders that Taxbrain can do for you!

No Comments... Yet!